Table of Contents

Introduction to Accounting for Startups

What is accounting and why is it critical for startups?

Starting a new business venture is an exciting and challenging journey. As an entrepreneur, you may focus on various aspects of your startup, such as developing a product or service, marketing, and attracting customers. However, amidst all the enthusiasm, one crucial area that often gets overlooked is accounting. Accounting plays a vital role in the success and sustainability of any business, especially for startups. In this blog post, we will explore the accounting basics and how it can contribute to its growth and long-term success.

Financial Management and Decision Making

Accounting provides entrepreneurs with accurate and timely financial information, enabling them to make informed decisions. By maintaining detailed records of income, expenses, and cash flow, startups can effectively manage their finances. Accounting helps monitor the financial health of the business, identify trends, and evaluate profitability. It also enables entrepreneurs to track costs, identify areas of overspending, and make necessary adjustments to improve efficiency and profitability.

Budgeting and Forecasting

One of the fundamental aspects of accounting is budgeting and forecasting. Startups need to plan their financial activities and set realistic goals for the future. By preparing budgets and financial projections, entrepreneurs can estimate their expected revenue, expenses, and cash flow. This helps in understanding the financial feasibility of the business and making strategic decisions. Regularly reviewing actual financial performance against the budget allows startups to identify any deviations and take corrective actions promptly.

Compliance with Legal and Regulatory Requirements

Accounting plays a significant role in ensuring startups comply with various legal and regulatory requirements. From tax obligations to financial reporting standards, businesses are required to maintain accurate and transparent financial records. Failure to meet these obligations can lead to severe penalties or legal consequences. By implementing proper accounting practices, startups can avoid non-compliance issues, mitigate risks, and maintain a good reputation in the market.

Attracting Investors and Securing Financing

For startups, attracting investors and securing financing is often crucial for growth and expansion. Investors and lenders rely on financial information to assess the viability and potential of a business. Accurate and organised accounting records build trust and credibility with external parties. Detailed financial statements and reports provide insights into the startup’s financial performance, profitability, and future prospects. Having a robust accounting system in place enhances the chances of securing funding and building strong relationships with investors.

Tracking Costs and Controlling Expenses

Startups often operate with limited resources and face tight budgets. Accounting helps in tracking costs and controlling expenses effectively. By maintaining a record of all expenses, businesses can identify areas of unnecessary spending and implement cost-cutting measures. Regular expense analysis enables entrepreneurs to make informed decisions regarding vendor selection, negotiating better deals, and optimising resource allocation. Effective cost management through accounting contributes to the overall profitability and sustainability of the startup.

Managing Cash Flow

Cash flow management is critical for the survival and growth of any business, particularly for startups. Accounting provides entrepreneurs with a clear picture of their cash inflows and outflows. By monitoring cash flow statements, startups can anticipate periods of cash shortages or surpluses. This allows them to plan and take necessary actions to ensure a healthy cash position. Efficient cash flow management helps in meeting financial obligations, paying suppliers on time, and seizing opportunities for growth.

Facilitating Tax Planning and Minimisation

Tax planning is an essential aspect of financial management for startups. Proper accounting practices enable businesses to organise their financial records and transactions in a tax-efficient manner. By understanding applicable tax laws and regulations, startups can identify deductions, exemptions, and credits to minimize their tax liability. Accounting also helps in timely preparation and submission of tax returns, avoiding penalties and interest charges. With effective tax planning, startups can optimise their cash flow and allocate resources strategically.

Still confused about accounting terms?! Test your vocabulary here: 50 Key Accounting Terms Every Founder Should Know

Setting Up Your Accounting System

How to choose the right accounting software for your business?

As a small business owner in Kenya, one of your top priorities is to keep a close eye on your finances. This includes monitoring the money you bring in and pay out. To effectively manage your finances, it is critical to have the right accounting software in place. A good accounting program will help you accomplish your daily accounting tasks, such as recording payments, tracking expenses, invoicing customers, and reconciling transactions. Additionally, it should provide you with the tools to analyze your business’s financial health by generating reports from multiple angles.

However, choosing the best accounting software for your business can be challenging. There are numerous options available, each with its own set of features and pricing plans. To simplify your search, here are three primary factors to consider when selecting accounting software:

Cost

One of the first factors to consider is the cost of the accounting software. Determine your budget and decide whether you prefer inexpensive, basic software or if you are willing to invest more for additional features. Keep in mind that some software may offer multiple pricing plans, so it is essential to evaluate the functionality and features included in each plan.

Usability

Another crucial factor is the usability of the software. Consider how many users will need access to the software and whether you prefer a cloud-based system or desktop software. Cloud-based software allows you to access your accounting data from anywhere with an internet connection, while desktop software is installed locally on your computer. Additionally, consider if you require a mobile app for on-the-go access and what capabilities you need the app to have.

Features

The features offered by the accounting software are also important to consider. Evaluate your specific needs and determine what functionalities are essential for your business. For example, do you need both accounts receivable and accounts payable tools? Are there specific accounting reports that you need to generate? Do you require the software to track inventory? Additionally, consider if you need any ancillary services, such as time tracking, project management, or payroll integration.

By considering these primary factors – cost, usability, and features – you can narrow down your options and find the accounting software that best suits your small business’s needs. Remember to thoroughly research each software option and take advantage of any free trials or demos offered by vendors. This will help you make an informed decision and ensure that the accounting software you choose will effectively support your financial management tasks.

Now, let’s take a look at some excellent accounting software options available for small businesses.

Step-by-step setup of basic accounting processes

Setting up basic accounting processes is essential for any business to manage its finances effectively. By following a step-by-step approach, you can establish a solid foundation for your accounting system. In this blog post, we will guide you through the process of setting up basic accounting processes.

Step 1: Establish Chart of Accounts

The first step is to create a chart of accounts, which is a list of all the different types of accounts your business will use to track its financial transactions. This includes assets, liabilities, equity, revenue, and expenses. By organizing your accounts in a logical and structured manner, you can easily track and categorize your financial data.

Step 2: Set Up a Bookkeeping System

Next, you need to establish a bookkeeping system to record and track your financial transactions. This can be done manually using spreadsheets or by using accounting software. Choose a system that suits the size and complexity of your business. Ensure that you record all transactions accurately and consistently.

Step 3: Implement a Payroll System

If you have employees, it is important to set up a payroll system to manage their wages, taxes, and deductions. This involves registering with tax authorities, calculating payroll taxes, and issuing pay stubs to your employees. Consider using payroll software to streamline this process and ensure compliance with tax regulations.

Step 4: Establish Financial Reporting

To monitor the financial health of your business, you need to establish a system for generating financial reports. This includes income statements, balance sheets, and cash flow statements. These reports provide valuable insights into your business’s performance and help you make informed decisions.

By following these step-by-step processes, you can set up a solid foundation for your accounting system. Remember to regularly review and update your processes to adapt to the changing needs of your business. With effective accounting processes in place, you can ensure the financial success of your business.

Understanding Financial Statements

What are the Major Financial Statements and Their Purposes?

Financial statements are essential documents that provide a snapshot of a company’s financial health. They help investors, creditors, and other stakeholders understand the company’s performance, profitability, and liquidity. There are three major financial statements:

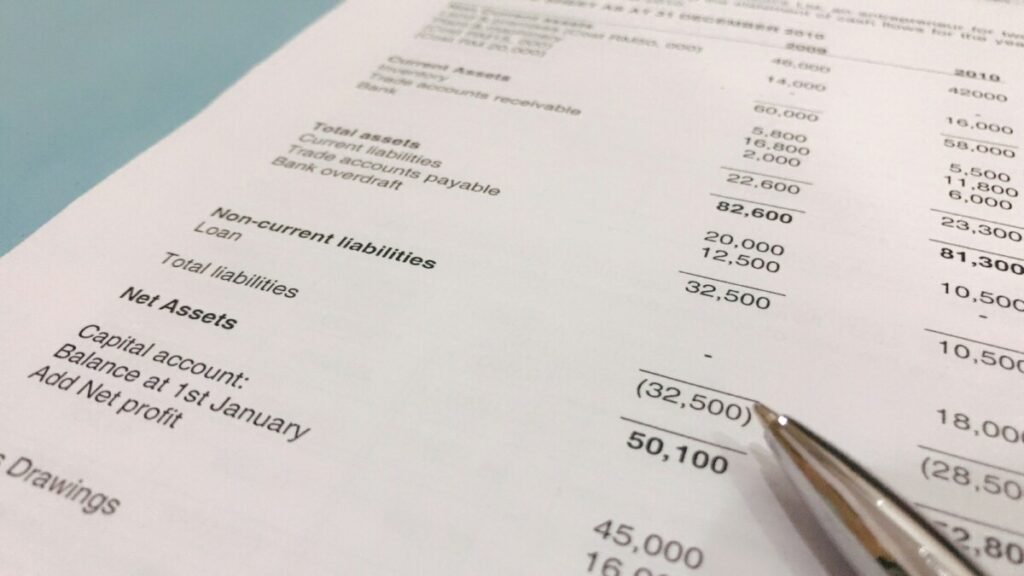

Balance Sheet

The balance sheet is a summary of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. It provides a clear picture of the company’s financial position and helps assess its solvency and ability to meet its obligations. Assets include cash, inventory, property, and equipment, while liabilities encompass debts, loans, and other obligations.

Income Statement

The income statement, also known as the profit and loss statement, shows a company’s revenues, expenses, and net income or loss over a specific period. It reveals the company’s ability to generate profits from its operations and highlights its cost structure. Revenues include sales, fees, and other income, while expenses cover costs such as salaries, rent, and utilities.

Cash Flow Statement

The cash flow statement tracks the movement of cash in and out of a company during a given period. It shows the company’s cash inflows from operating activities, investing activities, and financing activities. This statement provides insights into the company’s cash position, its ability to generate cash, and its financing and investment activities.

Each financial statement serves a specific purpose and provides valuable information to different users:

- Investors use financial statements to assess the company’s profitability and growth potential before making investment decisions.

- Creditors analyze financial statements to evaluate a company’s creditworthiness and determine the risk of lending money.

- Management relies on financial statements to monitor the company’s performance, identify areas for improvement, and make informed business decisions.

- Regulatory bodies require financial statements to ensure compliance with accounting standards and regulations.

Breaking Down the Components: Balance Sheet, Income Statement, Cash Flow Statement

Balance Sheet

The balance sheet is divided into three main sections: assets, liabilities, and shareholders’ equity. Assets represent what the company owns, liabilities represent what it owes, and shareholders’ equity represents the owners’ stake in the company. The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Shareholders’ Equity.

Assets are further categorized as current assets, such as cash and inventory, and non-current assets, such as property and equipment. Liabilities are classified as current liabilities, such as accounts payable and short-term debt, and non-current liabilities, such as long-term loans and bonds.

Income Statement

The income statement starts with the company’s total revenues, which are then reduced by the cost of goods sold (COGS) to calculate the gross profit. Operating expenses, such as salaries, rent, and marketing expenses, are then deducted from the gross profit to determine the operating profit. Non-operating income and expenses, such as interest income and taxes, are also considered to arrive at the net income or loss.

Cash Flow Statement

The cash flow statement consists of three sections: operating activities, investing activities, and financing activities. The operating activities section shows the cash generated or used in the company’s core operations, such as cash received from customers and cash paid to suppliers. The investing activities section reflects cash flows related to the purchase or sale of long-term assets, such as property and equipment. The financing activities section includes cash flows from borrowing or repaying loans, issuing or buying back shares, and paying dividends.

How to Read and Interpret Financial Statements?

Reading and interpreting financial statements requires some understanding of accounting principles and financial analysis. Here are some key steps to help you analyze financial statements:

1. Review the Balance Sheet

Start by examining the balance sheet to understand the company’s assets, liabilities, and shareholders’ equity. Look for trends over time, such as increasing or decreasing assets or liabilities. Pay attention to the composition of assets and liabilities to assess the company’s liquidity and financial stability.

2. Analyze the Income Statement

Next, analyze the income statement to assess the company’s profitability and cost structure. Look for trends in revenues, gross profit, and net income over time. Calculate key financial ratios, such as gross profit margin and net profit margin, to compare the company’s performance with industry benchmarks.

3. Evaluate the Cash Flow Statement

Examine the cash flow statement to understand the sources and uses of cash in the company’s operations, investments, and financing activities. Pay attention to the net cash flow from operating activities, as it indicates the company’s ability to generate cash from its core operations.

4. Compare Financial Statements

Compare the current financial statements with previous periods or industry averages to identify trends and potential areas of concern. Look for any significant changes in key financial ratios or indicators, such as a sudden increase in debt or a decline in profitability.

5. Consider Additional Information

Financial statements provide a snapshot of a company’s financial health, but they may not tell the whole story. Consider other factors, such as industry trends, competitive landscape, and management’s strategy, to gain a comprehensive understanding of the company’s financial position.

Remember, interpreting financial statements requires careful analysis and consideration of the company’s specific circumstances. It’s always a good idea to consult with financial professionals or seek further guidance if needed.

Daily Accounting Practices

What are best practices for managing daily accounting tasks?

Managing daily accounting tasks is crucial for the success of any business. By implementing best practices, you can ensure that your financial records are accurate, up-to-date, and organized. Here are some tips to help you streamline your daily accounting tasks:

1. Use Accounting Software

Gone are the days of manual bookkeeping. Investing in a reliable accounting software can save you time and reduce the risk of errors. With the help of automation, you can easily track income and expenses, generate financial reports, and reconcile bank statements.

2. Maintain a Chart of Accounts

A chart of accounts is a categorized list of all your financial transactions. It helps you organize your income, expenses, assets, and liabilities. By maintaining a well-structured chart of accounts, you can easily track the flow of money in your business and generate accurate financial statements.

3. Set Up Regular Reconciliation

Reconciling your bank accounts regularly is essential to ensure that your records match the bank’s records. This process involves comparing your transactions, deposits, and withdrawals with the bank statement. It helps identify any discrepancies and ensures that your financial records are accurate.

4. Implement Internal Controls

Internal controls are policies and procedures designed to safeguard your business’s assets and prevent fraud. By implementing internal controls, you can reduce the risk of errors, unauthorized transactions, and misappropriation of funds. Examples of internal controls include segregation of duties, regular audits, and limited access to financial information.

5. Keep Track of Receipts

Keeping track of receipts is essential for accurate record-keeping and tax purposes. Make it a habit to collect and organize receipts for all business-related expenses. This will help you claim deductions, track your expenses, and provide evidence in case of an audit.

Importance of Keeping Accurate Records

Accurate record-keeping is the foundation of good financial management. It provides insights into your business’s financial health, helps you make informed decisions, and ensures compliance with legal and tax requirements. Here are some reasons why keeping accurate records is crucial:

1. Financial Analysis and Decision Making

Accurate records enable you to analyze your business’s financial performance and make informed decisions. By tracking your income, expenses, and cash flow, you can identify trends, determine profitability, and plan for the future. This information helps you allocate resources effectively and make strategic business decisions.

2. Tax Compliance

Keeping accurate records is essential for meeting your tax obligations. It allows you to report your income accurately, claim deductions, and comply with tax regulations. In case of an audit, having organized and detailed records will help you provide the necessary documentation and support your tax filings.

3. Financial Reporting

Accurate financial records are necessary for preparing financial statements such as the balance sheet, income statement, and cash flow statement. These statements provide a snapshot of your business’s financial position, performance, and cash flow. They are often required by lenders, investors, and potential buyers to assess the viability and stability of your business.

4. Business Planning and Forecasting

Accurate records provide the data you need to create realistic business plans and forecasts. By analyzing historical financial data, you can identify patterns, project future revenue and expenses, and set realistic goals. This information is essential for securing funding, making investment decisions, and measuring your business’s growth.

5. Legal Compliance

Keeping accurate records ensures that your business complies with legal requirements. It allows you to track payments, invoices, and contracts, ensuring that you meet your obligations and avoid legal disputes. Accurate records also help protect your business in case of legal issues or audits.

Tips for Effective Cash Flow Management

Cash flow management is crucial for the financial stability and growth of your business. It involves monitoring, analyzing, and optimizing the flow of money in and out of your business. Here are some tips to help you manage your cash flow effectively:

1. Forecast and Plan

Develop a cash flow forecast that projects your future income and expenses. This will help you anticipate any cash shortages or surpluses and plan accordingly. By having a clear understanding of your cash flow, you can make informed decisions about spending, investments, and financing.

2. Monitor and Track

Regularly monitor and track your cash flow to identify any potential issues or trends. Use accounting software or spreadsheets to record and categorize your income and expenses. This will help you identify areas where you can reduce costs, improve efficiency, or increase revenue.

3. Manage Receivables and Payables

Efficiently managing your receivables and payables is crucial for maintaining a healthy cash flow. Implement clear payment terms and policies for your customers and suppliers. Encourage prompt payment from customers and negotiate favorable payment terms with suppliers to optimize your cash flow.

4. Control Expenses

Review your expenses regularly to identify any unnecessary or excessive costs. Look for opportunities to reduce overhead, negotiate better deals with suppliers, or find more cost-effective alternatives. Controlling your expenses will help free up cash and improve your cash flow.

5. Maintain Adequate Reserves

Having adequate cash reserves is essential for managing unexpected expenses or cash flow fluctuations. Set aside a portion of your profits as a contingency fund to cover emergencies or slow periods. This will provide a buffer and ensure that your business can continue operating smoothly.

By implementing these best practices for managing daily accounting tasks, keeping accurate records, and effectively managing your cash flow, you can ensure the financial stability and success of your business. Remember, consistency and attention to detail are key to maintaining a healthy financial position.

Tax Compliance for Kenyan Startups

Overview of Tax Obligations for Startups in Kenya

Starting a business can be an exciting and rewarding venture, but it also comes with certain responsibilities, including tax compliance. As a startup in Kenya, it is essential to understand your tax obligations to avoid any legal issues or penalties. Here is an overview of the tax obligations that startups in Kenya should be aware of:

1. Registering for Taxes

The first step in tax compliance for startups in Kenya is to register your business for taxes. This includes obtaining a Personal Identification Number (PIN) from the Kenya Revenue Authority (KRA). The PIN is a unique identifier that is used for all tax-related transactions and communications with the KRA.

2. Paying Income Tax

All startups in Kenya are required to pay income tax on their profits. The income tax rate for resident companies is currently 30%, while non-resident companies are subject to a rate of 37.5%. It is important to keep accurate records of your business income and expenses to calculate your taxable income correctly.

3. Value Added Tax (VAT)

If your startup’s annual turnover exceeds Kshs 5 million, you are required to register for Value Added Tax (VAT). VAT is a consumption tax that is charged on the supply of goods and services in Kenya. As a registered VAT taxpayer, you will be required to charge VAT on your sales and remit it to the KRA on a monthly basis.

What Are Common Tax Filing Mistakes ?

When it comes to tax compliance, startups in Kenya often make some common mistakes that can lead to penalties or unnecessary audits. Here are a few mistakes to avoid:

1. Late or Inaccurate Filing

One of the most common mistakes startups make is filing their tax returns late or with inaccurate information. Late filing can result in penalties and interest charges, while inaccurate information can trigger audits. To avoid these issues, it is crucial to keep track of tax filing deadlines and ensure that all information provided is accurate and up-to-date.

2. Failure to Keep Proper Records

Maintaining proper records is essential for tax compliance. Startups should keep records of all financial transactions, including sales, purchases, expenses, and payroll. These records will help you accurately calculate your taxable income and provide necessary documentation in case of an audit. Using accounting software or hiring a professional bookkeeper can help streamline this process.

3. Ignoring Tax Deductions and Credits

Many startups in Kenya fail to take advantage of available tax deductions and credits, resulting in higher tax liabilities. It is essential to familiarize yourself with the tax laws and regulations that apply to your business and identify any deductions or credits that you may be eligible for. Consulting with a tax professional can help you maximize your tax savings and ensure compliance.

Preparing for and Navigating Audits

While no one wants to go through a tax audit, it is essential to be prepared in case it happens. Here are a few tips for preparing for and navigating audits:

1. Keep Detailed Records

As mentioned earlier, maintaining detailed and accurate records is crucial. In the event of an audit, having organized and well-documented records will make the process smoother and help support your tax positions.

2. Seek Professional Assistance

If you receive an audit notice from the KRA, it is advisable to seek professional assistance from a tax consultant or accountant. They can guide you through the audit process, help you understand your rights and obligations, and represent you during discussions with the KRA.

3. Cooperate and Respond Promptly

During an audit, it is essential to cooperate with the KRA and respond promptly to any requests for information or documentation. Failure to do so can result in penalties or further scrutiny. Be prepared to provide any necessary supporting documents and answer any questions truthfully and to the best of your knowledge.

In conclusion, tax compliance is a crucial aspect of running a startup in Kenya. By understanding your tax obligations, avoiding common filing mistakes, and being prepared for audits, you can ensure that your business operates within the legal framework and avoids unnecessary penalties or legal issues. Consider seeking professional advice when necessary, and always stay updated on changes in tax laws and regulations to maintain compliance.

Payroll Management For Startups

As a startup founder, setting up a payroll system can be a daunting task. However, it is crucial to ensure the smooth and efficient management of your employees’ salaries and benefits. In this chapter, we will cover the main topics that you need to consider when setting up a payroll system for your startup.

Understanding Payroll Taxes and Deductions

One of the key aspects of payroll management is understanding payroll taxes and deductions. Payroll taxes are the taxes that employers are required to withhold from their employees’ wages and remit to the appropriate tax authorities. These taxes include state, and local income taxes, as well as Social Security taxes.

Additionally, deductions play a significant role in payroll management. Deductions can include employee contributions to retirement plans, health insurance premiums, and other benefits. It is essential to understand the various types of deductions and ensure accurate calculations and deductions are made.

Understanding payroll taxes and deductions can be complex, especially for startup founders who are new to the area. Seeking professional advice or using payroll software can help simplify the process and ensure compliance with tax regulations.

Legal Considerations in Payroll Management

Payroll management also involves several legal considerations that startup founders need to be aware of. These considerations include compliance with labor laws, employee classification, and record-keeping requirements.

Startup founders must familiarize themselves with the labor laws applicable to their jurisdiction, such as minimum wage laws, overtime regulations, and employee leave entitlements. It is important to ensure that your payroll system adheres to these laws to avoid legal issues and penalties.

Employee classification is another crucial aspect of payroll management. Startup founders need to determine whether their workers are classified as employees or independent contractors. This classification affects tax withholding requirements and benefits eligibility.

Lastly, maintaining accurate and organized payroll records is essential for legal compliance. Startup founders should keep records of employee wages, tax withholdings, and other relevant information for a specified period. This documentation will be crucial in case of audits or legal disputes.

Financial Planning and Analysis

How to Use Accounting Data for Better Business Decision-Making

Financial planning and analysis play a crucial role in the success of any business. By using accounting data effectively, businesses can make informed decisions that drive growth, increase profitability, and mitigate risks. In this article, we will explore three key areas where accounting data can be utilized to enhance decision-making: budgeting basics, financial forecasting, and strategic analysis.

Budgeting Basics: How to Create and Manage Budgets

A well-designed budget serves as a roadmap for a business, helping to allocate resources, set goals, and track progress. By utilizing accounting data, businesses can create accurate and realistic budgets that align with their strategic objectives.

One of the first steps in budgeting is to gather historical financial data. This data provides insights into past performance, allowing businesses to identify trends and patterns. By analyzing this information, businesses can make informed decisions about future revenue and expenses.

Once the historical data has been analyzed, businesses can start creating their budget. This involves estimating future revenue and expenses based on market conditions, industry trends, and internal factors. By using accounting data, businesses can ensure that their budget is realistic and achievable.

Managing a budget is equally important. Regularly monitoring actual performance against the budget allows businesses to identify any deviations and take corrective actions. By analyzing accounting data, businesses can gain valuable insights into their financial performance, identify areas of improvement, and make timely adjustments to their operations.

Financial Forecasting: Predicting Future Revenue and Expenses

Financial forecasting is a critical component of financial planning and analysis. By using accounting data, businesses can predict future revenue and expenses, enabling them to make informed decisions about resource allocation, investment opportunities, and strategic initiatives.

Accounting data provides valuable insights into a business’s historical performance. By analyzing this data, businesses can identify trends, patterns, and seasonality. This information can then be used to make accurate forecasts about future revenue and expenses.

Financial forecasting involves analyzing various factors that can impact a business’s financial performance. These factors may include market conditions, industry trends, customer behavior, and changes in regulations. By incorporating accounting data into the forecasting process, businesses can make more accurate predictions and reduce uncertainty.

Regularly reviewing and updating financial forecasts is essential. As market conditions and business dynamics change, it is crucial to adjust forecasts accordingly. By analyzing accounting data and comparing it to the forecasted figures, businesses can identify any deviations and take proactive measures to ensure financial stability and growth.

Strategic Analysis: Leveraging Accounting Data for Growth

Strategic analysis involves using accounting data to evaluate the financial health of a business and make informed decisions about its future direction. By analyzing financial statements and key performance indicators, businesses can identify areas of strength and weakness, assess profitability, and evaluate the success of strategic initiatives.

Accounting data provides a comprehensive view of a business’s financial performance. By analyzing financial statements such as the balance sheet, income statement, and cash flow statement, businesses can assess their liquidity, solvency, and profitability. This information enables businesses to make strategic decisions that align with their long-term goals.

Key performance indicators (KPIs) are another valuable tool in strategic analysis. By tracking KPIs such as revenue growth, gross profit margin, and return on investment, businesses can measure their performance against industry benchmarks and identify areas for improvement. Accounting data plays a crucial role in calculating and analyzing these KPIs.

Strategic analysis also involves evaluating the success of strategic initiatives and investment decisions. By analyzing accounting data, businesses can determine the return on investment (ROI) of various projects and assess their impact on the overall financial performance.

What are Common Accounting Challenges in Kenya?

Accounting plays a crucial role in the financial management of businesses in Kenya. However, there are several challenges that accountants commonly face in this country.

1. Tax Compliance

One of the major challenges for accountants in Kenya is ensuring tax compliance. The tax laws and regulations in Kenya can be complex and subject to frequent changes. Accountants need to stay updated with these changes to ensure accurate tax calculations and timely submission of tax returns.

2. Limited Access to Technology

Another challenge is the limited access to technology. Many businesses in Kenya, especially small and medium-sized enterprises (SMEs), still rely on manual accounting systems. This can lead to errors, inefficiencies, and delays in financial reporting.

3. Lack of Professional Skills

There is also a shortage of qualified accountants with the necessary professional skills in Kenya. This can result in a lack of expertise in areas such as financial analysis, budgeting, and forecasting. It is important for businesses to invest in training and development programs to enhance the skills of their accounting staff.

To tackle these and many other challenges, a modern, professional accounting, payroll services, and CFO as a service provider such as Revise can stay updated with these changes. They can invest in continuous training and professional development programs for their staff to ensure accurate tax calculations and timely submission of tax returns. Furthermore, a professional service provider can address offere moder cloud-based accounting software and digital solutions. This allows businesses to automate their accounting processes, improve accuracy, and have real-time access to financial data.

Important Links

Dont forget to take a look at our other relevant posts:

- Setting Up Your Accounting System: A Step-by-Step Guide

- Common Accounting Mistakes and How to Avoid Them

- Understanding Financial Statements: Balance Sheet, Income Statement, and Cash Flow